Longevity InsurTech End-to-End Platform Solution

Longevity InsurTech End-to-End Platform Solution is a set of solutions designated specifically for the Insurance Industry aiming to serve the complex of goals, namely accelerating the adoption of innovations and tech-backed solutions widely known as InsurTech, bringing more efficiency to the industry, meeting the needs of Insurance companies and contributing to emergence of new InsurTech solutions.

6 Platform's Components

Solutions Tailored to InsurTech Industry

Broad Coverage of Solutions

Full Overview of InsurTech Industry

Project Rationale

The Insurance Industry experiences the essential need for the greater adoption of innovations and tech-backed solutions widely known as InsurTech. In order to accelerate this process and bring more efficiency, Deep Knowledge Group is launching a set of solutions designated specifically for the Insurance Industry.

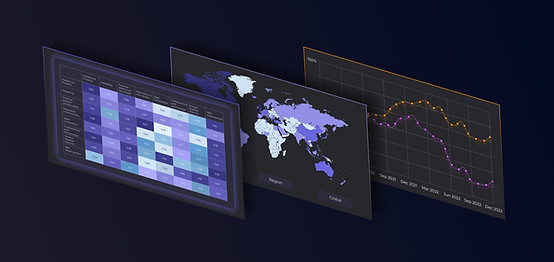

InsurTech Industry Big Data Analytical System and Dashboard

The white-label solution for corporations that integrates the most sophisticated tools for comprehensive market intelligence, competitors landscape mapping, identification of targets for M&A deals, and technological trends monitoring across the InsurTech Industry.

.png)

Components of InsurTech End-to-End

Platform Solution

InsurTech Ranking and Benchmark Agency

The specialized agency aims to develop tangible, data-driven InsurTech Industry benchmarks based on a comprehensive analysis of collected market data. The core use case of the agency is the generation of valuable analytics for decision-makers to better understand and track new developments across the InsurTech Industry.

InvestTech Platform for Private Equity

One-stop solution that meets multiple goals in private investing: the ideal tool for InsurTech start-ups to boost fundraising and for investors to deploy capital securely. Access to such systems can help corporations become key market players in the rapidly-diversifying InsurTech Industry.

Thematic InsurTech Multilateral Trading Facility (MTF) /Alternative Trading System (ATS)

Trading venue providing access to additional capital for matured InsurTech companies, both financially and technologically, to enhance growth and expansion. The establishment of this thematic Alternative Trading System will bring strategic dominance to the corporations that initiate the establishment of ATS/MTF

Specialized Solutions for InsurTech Companies

A series of additional solutions that would be of special interest for InsurTech companies: integration with mHealth solution, Longevity Risk Modeling Dashboard, and integration with FinTech solutions. The implementation of these solutions will secure a stronger competitive position and enable significant enhancements for InsurTech companies.

Strategic Benefits of InsurTech Platform Solution

01

Integrated Platform Solution Meeting Multiple Needs of Insurance Companies

02

Permanent Enhancement of the Platform’s Components to Satisfy the Strategic Goals of the Client

03

Validated and Operational Solutions

Longevity InsurTech Industry

Overview 2023

While the majority of practical outcomes in healthy Longevity will be driven by precision health technologies, they will also require an assembly of other, nonbiomedical components, including traditional financial products and services such as Longevity Insurance and InsurTech.

%20(4).png)